IR35

What does IR stand for in IR35. IR35 also known as the Off-Payroll Working Rules may apply when the freelancer operates under a personal services or similar company.

Ir35 New Hmrc Consultation On Reform Of Off Payroll Tax Rules Jurit

These rules allow HMRC to collect Income Tax and National Insurance in.

. The off-payroll working rules apply on a contract-by. Wed like to set additional cookies to understand how you use GOVUK. IR35 is the abbreviated name for the anti-tax avoidance legislation that was introduced in April 2000.

If your business does meet the above conditions then there are two ways to determine the IR35 status of your workers. Essentially IR35 affects all contractors who do not meet HMRCs definition of self employment. While IR35 had previously been present within the.

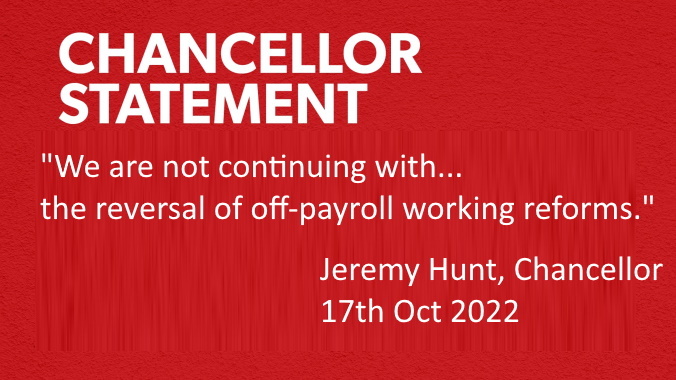

The new chancellor Jeremy Hunt has scrapped the IR35 reform repeal that was planned by his predecessor Kwasi Kwarteng. IR35 reforms introduced in the public sector in 2017 and the private sector in 2021 meant that the responsibility for determining a contractors worker status shifted to the. The IR35 tax avoidance reforms were first introduced in the public sector back in April 2017 and ushered in a sizeable shift in responsibility within the extended end-client-to.

The definition of small business for IR35 exemptions is likely to be based on the definition in the Companies Act which is met if a company meets any two of the three triggers below. Theyve also U-turned on the reduction of dividend rates. The whole point of increasing them was to mirror the increase to national insurance.

But now theyve scrapped the national insurance. September 23 2022 134 pm. List of information about off-payroll working IR35.

It was introduced to combat the problem of disguised employment. IR35 is a piece of tax legislation designed to stop companies from employing contractors as disguised employees. The IR35 rules will result in an increased tax and NI.

The rules to counter alleged tax avoidance via the use of personal. IR35 is a piece of legislation which allows HMRC to treat private contractors as if they were employees. Self-employed IR35 rules are.

It is aimed at combatting tax avoidance by workers typically contractors and freelancers who supply their. Self-employed IR35 rules are designed to work out whether a contractor is someone who is genuinely self-employed rather than a disguised employee for the purposes. 2 min read.

The term IR35 refers to the press release that originally announced the legislation in 1999. Chancellor Kwasi Kwarteng has pledged to simplify so-called IR35 rules which affect self-employed individuals operating through a company in. IR35 is another name for the off-payroll working rules.

The IR35 reform will be repealed from April 6 2023 according to this mornings mini-Budget. The IR stands for Inland Revenue and. Speaking to the House of Commons today September 23 Chancellor Kwasi.

HMRC have done this by targeting limited company. October 17 2022 1102 am. On September 23 the UK Government announced their mini-budget.

A contract for the purpose of the off-payroll working rules is a written verbal or implied agreement between parties. And in a surprising twist IR35 changes off-payroll working rules will be repealed from April. Definition of IR35 IR35 is the term commonly used to refer to HMRCs off-payroll working rules.

IR35 is tax legislation intended to stop disguised employment. IR35 also known as the Off-Payroll tax rules was created to both protect workers rights and reduce tax avoidance. IR35 guide for hirers.

In general IR35 shifts the responsibility of worker. We use some essential cookies to make this website work. The Intermediaries Legislation aka IR35 was first mentioned in a 1999 Inland Revenue press release.

Ir35 Shock As Chancellor Jeremy Hunt Says Contractors Must Pay Same Tax As Employees It Contractor It Contracting News Advice

What Does Ir35 2021 Mean For Sameday Couriers Da Systems

Ir35 Update Finance Bill Published

How Companies Can Prepare For The Ir35 Changes Med Tech Innovation

Overcoming Ir35 Changes With Global Development Teams

What You Need To Know About The Uk Ir35 Rules Goglobal

The Ir35 Changes Are Here What Does It Mean For You Rouse Partners Award Winning Chartered Accountants In Buckinghamshire

What Is Ir35 Off Payroll Working

Changes To Ir35 Legislation Gazelle Global Consulting

Large And Medium Sized Businesses Need To Be Ready For Ir35 Accountants Bury St Edmunds Thetford Knights Lowe

What Does The Repeal Of Ir35 Mean For Businesses And Contractors Mgi Midgley Snelling Llp

Is Ir35 Being Scrapped Ir35 Changes Proposed In Mini Budget Cancelled