iowa disabled veteran homestead tax credit

Homestead Credit Disabled Veteran Homestead Credit Military Exemption and Business Property Tax Credit Sign-Up Deadline NOVEMBER 1 Family Farm Tax Credit Sign-Up Deadline FEBRUARY 1 Exempt Property Religious Literary Charitable Forest ReserveFruit Tree. The state also offers a homestead tax credit and property tax relief for active military personnel.

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

This benefit also applies to Iowa veterans who hae been rated by the VA as Individually Unemployable 100 TDIU.

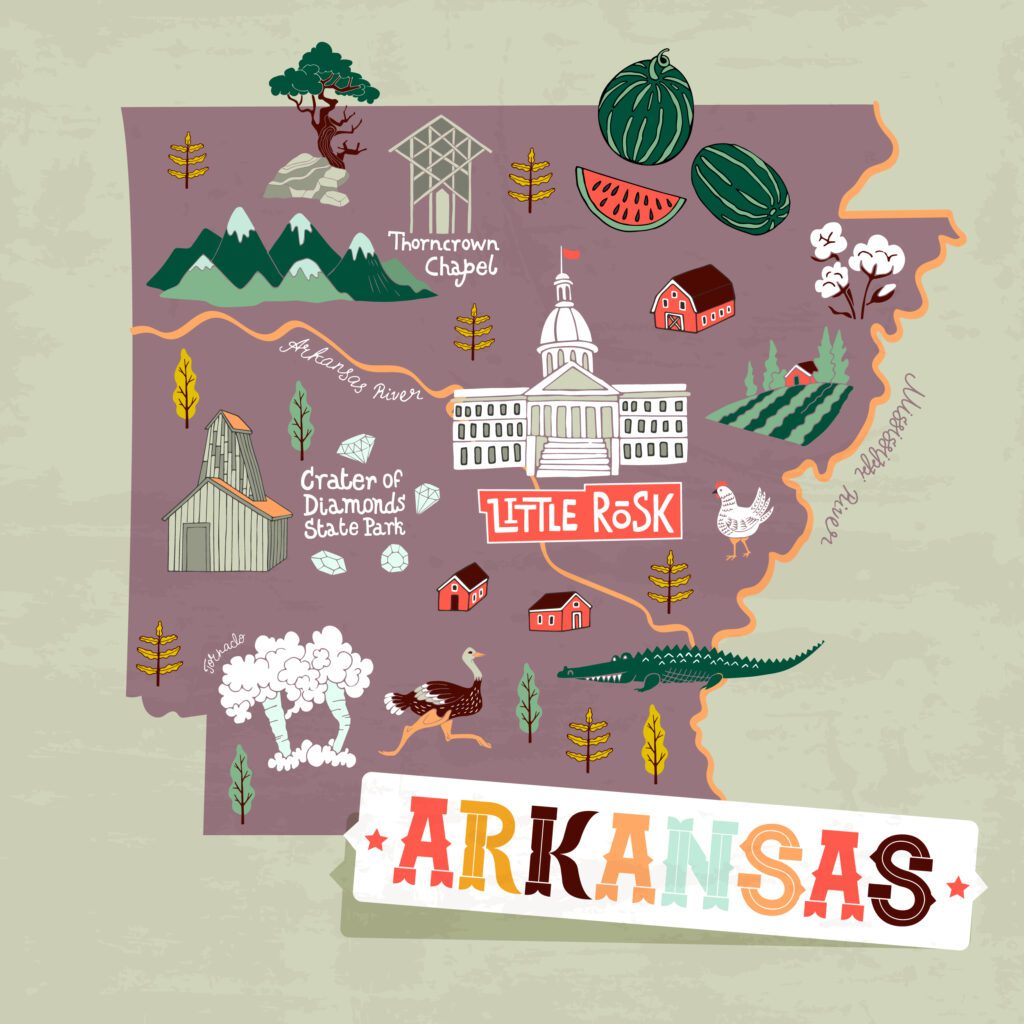

. Disabled Veterans Homestead Tax Credit. Military Retirement Tax Exemption. This legislation from the year 2014 provides 100 exemption of property taxes for 100 disabled service-connected veterans and Dependency and Indemnity Compensation DIC recipients.

Veterans with a disability rating of 70 percent or more. Other deductions and credits like the Senior Citizen or Disabled Property Owner Tax Relief program and the First-Time Homebuyer Individual Income Tax Credit help to. Board of Review Homestead Family Farm New Business Property Disabled Veteran Homestead Petition to Local Board of Review Disaster Counties Petition Tax Exemption Applications Military Geothermal Grain Tax Forest Fruit Tree Reservations Non-Profit Charitable Organizations Native Prairie or Wetlands Industrial Historic Improvement.

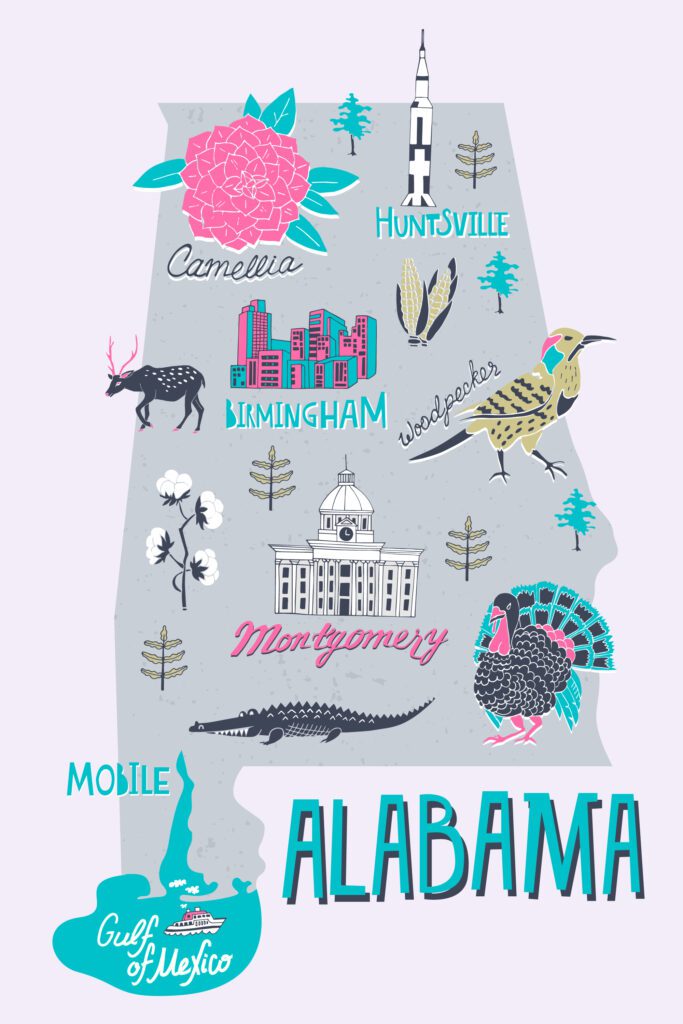

At least 65 years old or 100 disabled. Disabled Veterans Homestead Tax Credit Application. A disabled veteran in Minnesota may receive a property tax exemption of up to 300000 on hisher primary residence if the veteran is 100 percent disabled as result of service.

At least 50 disabled with less than 36300 in annual household income. The Age 65 or Disabled Homeowner Property Tax Relief program freezes the property value to the amount on date the homeowner turned 65 or the date of disability. Up to 700 refund on property taxes for homes worth up to 350000.

A surviving spouse who is the beneficiary of a qualified veterans estate may continue to receive the credit already. All households are eligible for the Arkansas Homestead Tax Credit of up to 375 regardless of income or age. Iowa State Association of Assessors.

Iowa veterans with a 100 Permanent and Total PT VA rating are exempt from paying property taxes on their primary residence. Department of Iowa Revenue Apply. Served on active duty during a war or at least 18 months in peacetime.

Find Your Property Data Owner. Up to 1852 in property value exempted. If a qualified individual buys a new homestead property they can apply to have the taxable.

Iowa Military And Veterans Benefits The Official Army Benefits Website

Military Veteran Families Work Life Resources

Disabled Veterans Property Tax Exemptions By State

![]()

Online Credit And Exemption Sign Up Mahaska County Iowa Mahaskacountyia Gov

Disabled Veterans Property Tax Exemptions By State

Veteran Benefits For Iowa Veterans Guardian Va Claim Consulting

Top 7 Iowa Veteran Benefits For 2021 Va Claims Insider

Iowa Military And Veterans Benefits The Official Army Benefits Website

Credits Exemptions City Of Ames Ia

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

States With Property Tax Exemptions For Veterans R Veterans

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider